are raffle tickets tax deductible if you don't win

0 out of 0 found this helpful Have more questions. Can i deduct the cost of raffle tickets purchased from non profit organizations.

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Learn More at AARP.

. Are Dental Implants Tax. Are raffle tickets tax deductible if you dont win. Ad Easy Software To Help You Find All the Tax Deductions You Deserve.

6 Often Overlooked Tax Breaks You Dont Want to Miss. Grab a 5 ticket in the Cancer Council WA Raffle and youll be in the running to win our Major Prize Draw PLUS our Early Bird and Bonus Prize Draws. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by.

You face potential lawsuits if you dont meet your obligation to provide the prizes you. Are Raffle Tickets Tax Deductible If You Dont Win. Restaurants In Matthews Nc That Deliver.

6 Often Overlooked Tax Breaks You Dont Want to Miss. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Much like how buying a charity raffle ticket is nondeductible gambling.

Exempt under section 501 of the Internal Revenue Code. August 30 2021 1751 Updated Although raffles tickets are a form of donation they are not tax deductible. In fact youre not entitled to any charitable deduction for raffle tickets you purchase even if the raffle is sponsored by a tax-exempt organization.

If you win the raffle you may even end up owing. One or more ticket-holders win prizes. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

To hold a raffle you sell people tickets then have a drawing. The purchase of a raffle ticket is not tax-deductible. Tax on winnings should be reported to you in Box 1 reportable winnings of IRS Form W-2G.

Raffle sponsors keep tickets. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

It may be deductible as a gambling loss but only up to. A tax-exempt organization that sponsors raffles may be required to secure information about the winners and file reports on the prizes. June 1 2019 112 PM Unfortunately its 3.

Restaurants In Erie County Lawsuit. For the purpose of determining your personal federal income tax the cost of a raffle ticket is not deductible as a charitable contribution. Was this article helpful.

Per IRS pub 526 page 6 If you receive or expect to receive a financial or. Although you cannot take a tax deduction for buying a raffle ticket you may be able to deduct the amount spent on losing tickets to the extent you had gambling winnings of. If you actually win any of the prizes you are required to report those additional earnings on your taxes.

Whether your winnings relate to lottery tickets casino winnings or sports and racetrack winnings the IRS treats the windfall as taxable gambling winnings that youre. Although you cannot take a tax deduction for buying a raffle ticket you may be able to deduct the amount spent on losing tickets to the extent you had gambling winnings of at least that. One ticket three chances to win.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The IRS classes money spent on raffles and lotteries as contributions from which you benefit and therefore it is generally not deductible. If you itemize you can only deduct gambling losses against winnings and youre not allowed to claim raffle or lottery tickets as a.

This is because the purchase of raffle. Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a. Learn More at AARP.

Casino Night Invitation Casino Night Fundraiser Casino Night Invitations Casino Night

Little Guide To Corporate Gifting Employee Christmas Gifts Corporate Holiday Gifts Amazing Christmas Gifts

What Happens If I Win A Prize Is It Taxable 2022 Turbotax Canada Tips

Weirdest Things Canadians Have Tried To Claim On Their Taxes H R Block Canada

Are My Prize Or Lottery Winnings Taxed

6 Amazing Tips For Asking For Donations With Emails Qgiv Blog

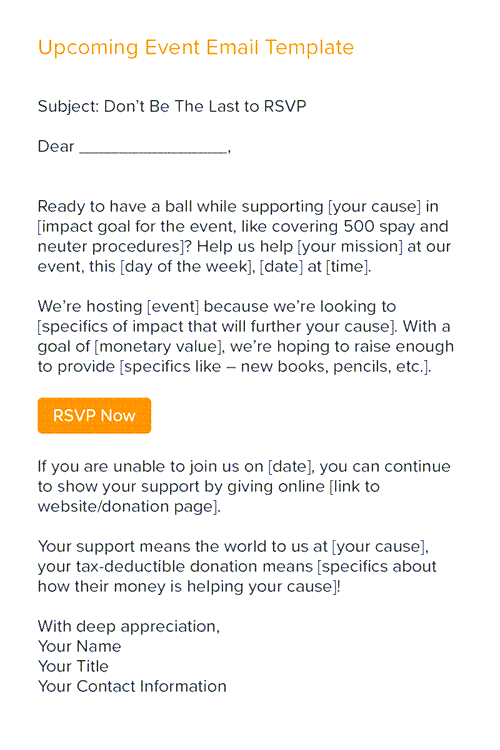

Wix Forms Adding And Setting Up A Donation Form Help Center Wix Com

What Is A Windfall And How Does It Apply To Me 2022 Turbotax Canada Tips

Crypto Staking Taxes Ultimate Guide Koinly

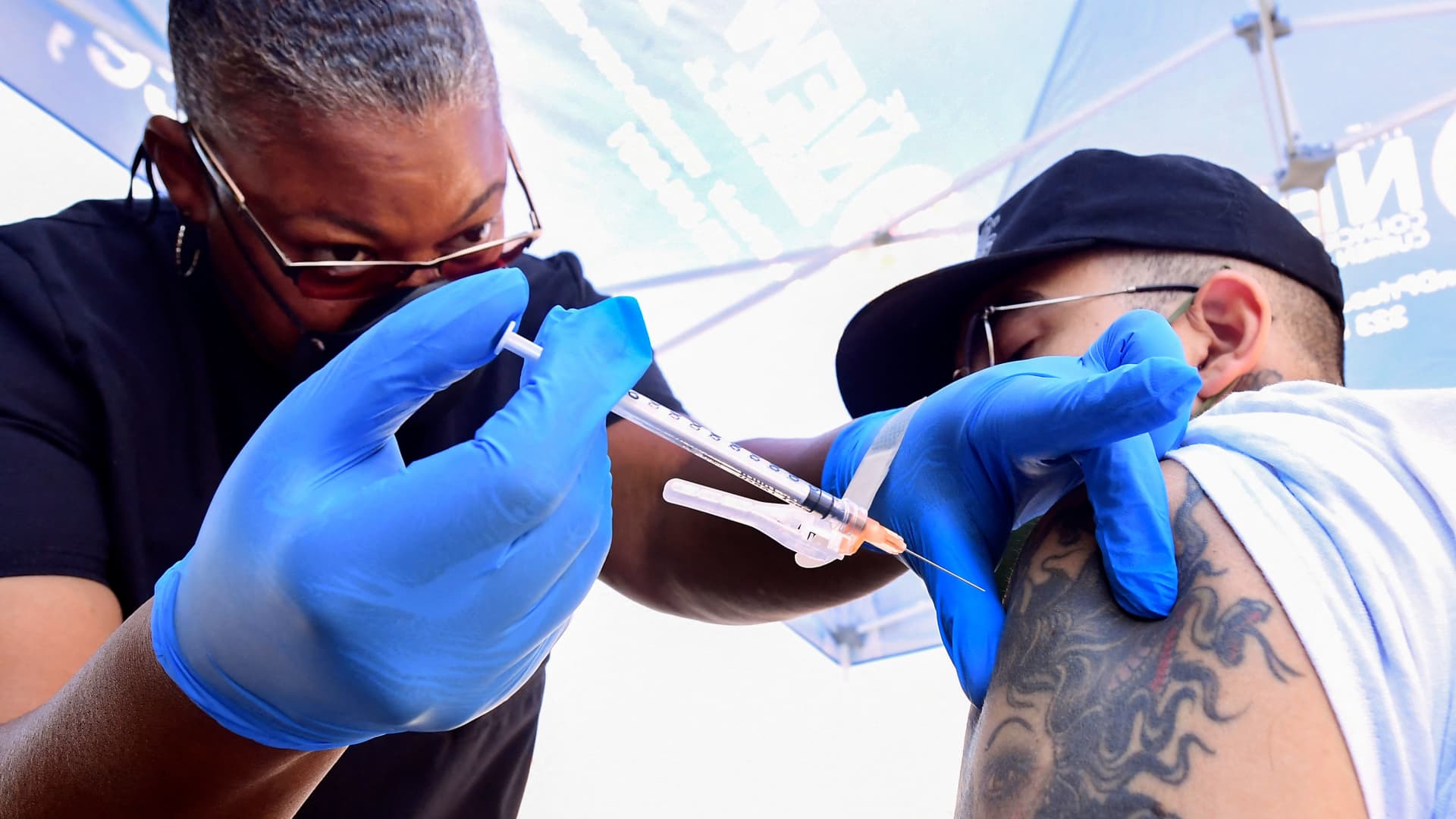

Here S How Much Vaccine Lottery Winners Can Expect To Pay In Taxes

Rules For Charitable Gaming Activities Thompson Greenspon Cpa

Rules Regulations Pne Prize Home

35 Quotes That Will Help Set Your Weeks Intentions Because Im Addicted Work Quotes Inspirational Words Wayne Dyer Quotes

Are Nonprofit Raffle Ticket Donations Tax Deductible

The 2020 Norton Children S Hospital Home Bmw Raffle Home Tickets Are Now On Sale Get Your Ticket Early For A Ch Childrens Hospital Beautiful Homes Hospital

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

What Is A Windfall And How Does It Apply To Me 2022 Turbotax Canada Tips